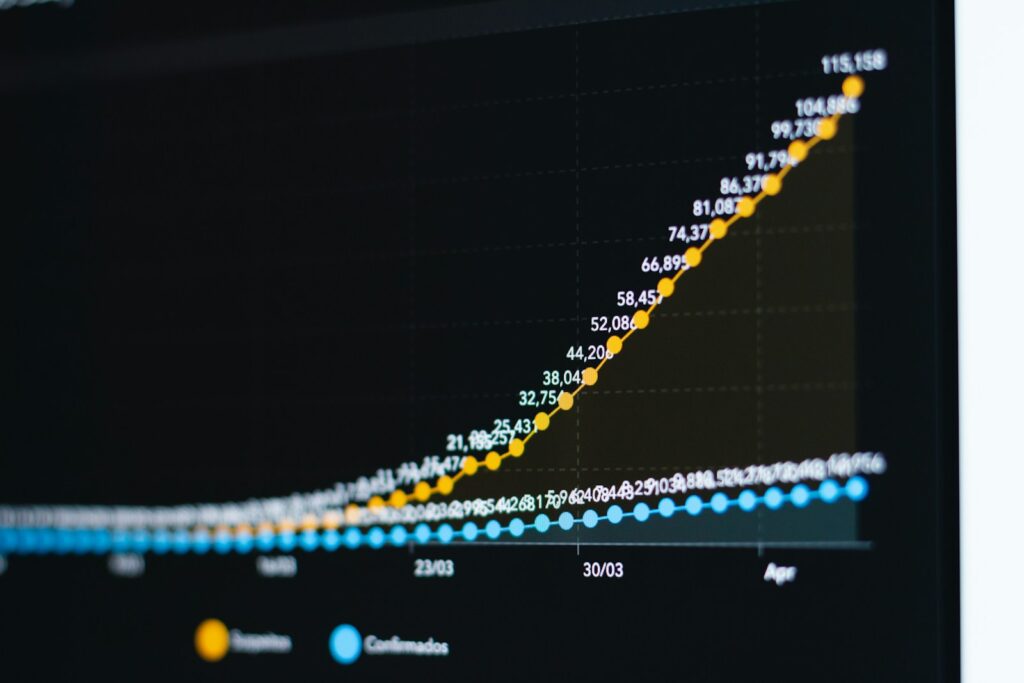

Should You Realize Capital Gain?

Have been noticing a conversation that’s come up repeatedly — Being locked into in-house proprietary funds where any future adjustment or move means triggering capital gains on your entire portfolio. To help you think through this challenge before it becomes urgent, I created this focused 5-minute video specifically for this…