The “Nifty Fifty” concept first appeared in the North American market in the 1960s, reflecting the ardent pursuit of 50 North American growth stocks by individual investors, institutions, and media at the time. These were seen as “must-buy and hold forever” quality companies, despite their already high prices. By 2025, less than half of the Nifty Fifty companies will still be included in the S&P 500 index.

Then followed the 1990s globalization tsunami, which gave rise to the common acronym “BRIC” (Brazil, Russia, India, and China), which is taken from the initials of these four developing market countries. After entering the 2000s, the “FANG” tech stock concept and its several derivative variants took turns onstage over the next decade.

In 2025, new terminology such as “SUSHI” (stocks that no longer generate interest) have arisen, making traditional stocks no longer a popular topic. Instead, youthful investors are obsessed with speculative concepts such as cryptocurrencies, the metaverse, AI algorithmic funds, venture capital, and private equity. Although these products are currently experiencing rapid growth and have enormous social and economic worth, someone without professional domain knowledge who can only understand through news and social media frequently converts critical investment decisions into easy follow-the-trend games.

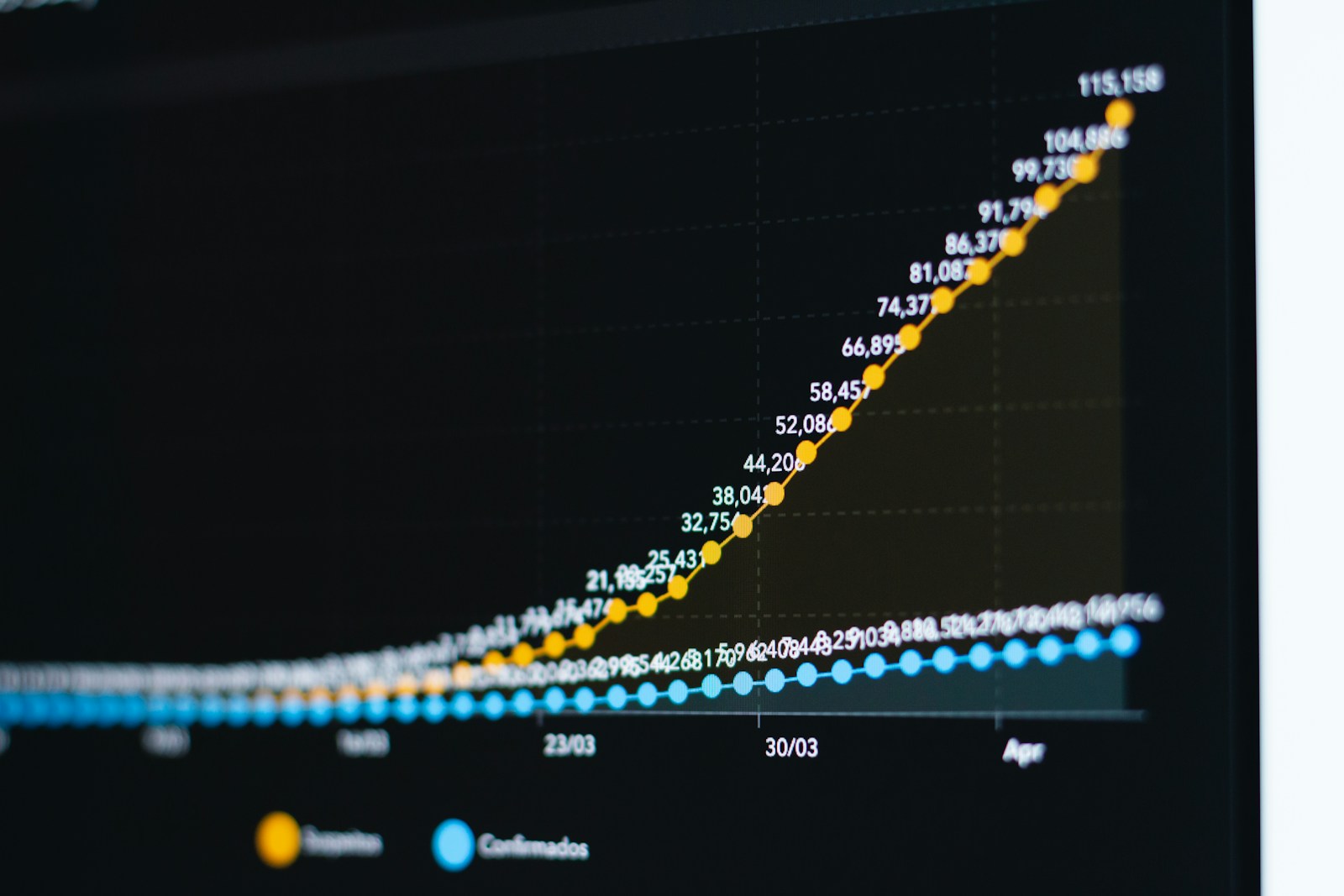

The “Mag 7” is a typical case study: ten years ago, its annualized returns surpassed 25%, but this year’s overall gain was just 5.5%, significantly below than market forecasts. Apple and Tesla reported negative returns of -13% and -16%, respectively, in stark contrast to the “Magnificent” concept moniker. The internal divergence within the portfolio reached 53%, with a significant disparity between the greatest performer, NVIDIA, and the worst performer, Tesla, showing that examining these firms as a single investment theme is no longer useful. The word “Magnificent” is more reflected in the companies’ absolute scale than in their stock market performance.

When a notion obtains broad notice, it may still have some short-term benefits, but its optimal investment return period is frequently reaching its end.

For youthful high-net-worth investors, the key to investing is not chasing opportunities that are not theirs, nor should they target annual returns of more than 25% while ignoring potential black swan risks. It is more necessary to learn the logic behind new concepts from specialists and increase risk control knowledge. Finding a balance between notions and reasoning, avoiding large concentrated bets, participating modestly, capitalizing on growth possibilities while progressively increasing the long-term compounding effect of stable assets.

Professional asset management operations and planning is possible to lead to consistent annual returns of 20% or higher. What genuinely requires monitoring is excessive allocation due to short-term hype and a lack of discernment.