One of Canada’s Big Five banks, BMO, through its GAM Global Asset Management team, made a strategic decision during the COVID period that was framed as “long-term defensive positioning” for client portfolios. The stated objective was capital protection under pandemic uncertainty.

In practice, this resulted in an ultra-conservative, long-duration fixed income strategy.

Several private wealth bond portfolios were structured with durations locked around eight years, while delivering stable yields of under 4%. This was presented as maximum risk control for clients during the pandemic.

I personally attended the internal meeting where this strategy was discussed and raised clear concerns. The core issue was not risk control — it was lack of flexibility. No one can predict interest-rate movements over an eight-year horizon. Locking clients into long-duration structures removed adaptability and optionality from the portfolio. I explicitly recommended reconsidering the maturity structure. The responses from the analyst team were vague and non-committal.

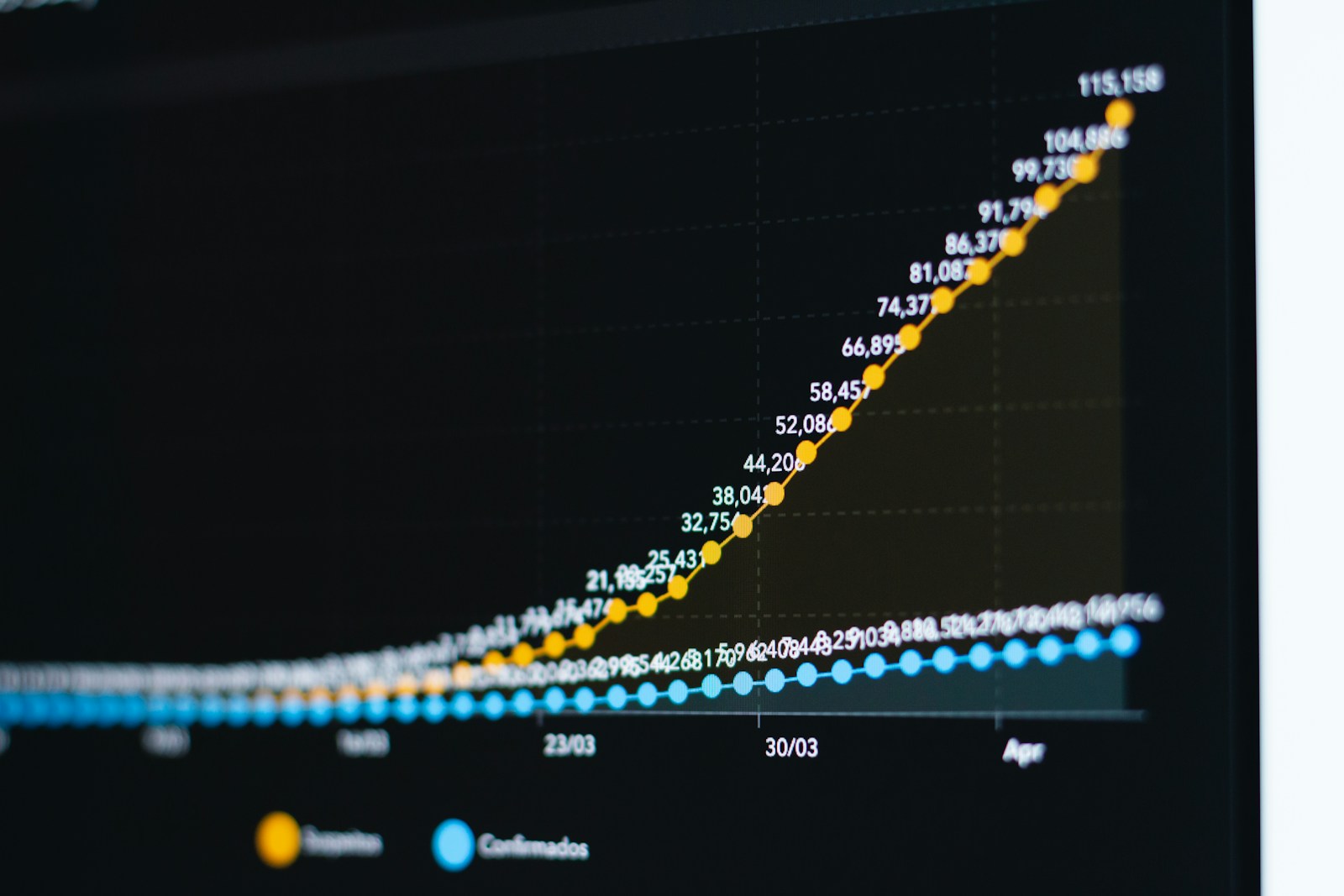

Now, three years later, the pandemic environment has long passed — yet many investors are still holding bond portfolios with average remaining durations of approximately five years.

Meanwhile, the market now offers low-risk fixed income instruments yielding up to 7%. Investors are left with two suboptimal choices:

-

Accept structurally lower returns for the next five years

-

Or sell at a discount and roll the capital into new instruments, realizing losses

What was framed as “protection” has become structural opportunity loss.

At the time, this ultra-long duration strategy appeared conservative and responsible. In reality, it reflected institutional inexperience. Much of the portfolio construction was driven by junior analysts with limited cycle experience, resulting in long-term damage to client outcomes once the crisis environment normalized.

The deeper driver behind this behavior is not long-term value creation — it is fear of client attrition.

Banks understand that short-term volatility and temporary drawdowns often trigger client departures. As a result, institutions systematically favor strategies that look safe, even when they produce mediocre long-term outcomes. They prioritize short-term emotional stability over long-term capital growth.

In avoiding short-term discomfort, they sacrifice long-term wealth creation.

True long-term investment management requires entrepreneurial thinking — not cosmetic stability.

It means taking intelligent, compensated risk, not optimizing for smooth charts.

Portfolio managers must move beyond transactional relationships and build deep, life-cycle wealth partnerships, delivering value across generations, not quarters.

Sustainable long-term returns are not created by simply extending time horizons.

They come from understanding risk, pricing risk, and using risk.

This requires capital managers to evolve from passive product allocators into active value seekers and value creators — executing decisively, staying disciplined through volatility, and maintaining patience through cycles.

Only when investors step outside bank-designed product frameworks — and begin identifying, owning, and holding fundamentally undervalued, high-quality assets — can true long-term wealth growth occur.

In this process, simple, transparent, fundamentals-driven strategies consistently outperform complex, opaque, and heavily packaged financial products.

Not because they are flashy — but because they are structurally aligned with how real wealth is built.