Among professionals in large tech companies who are preparing to change jobs, one topic is discussed repeatedly:

What should be done with large holdings of former employer stock after departure?

Selling immediately triggers substantial capital gains tax.

Holding exposes the investor to market volatility and concentration risk.

The simplest structural solution is often a Covered Call strategy.

I have a client in Toronto who is currently a surgeon at UHN, and previously spent ten years at Eli Lilly. Upon leaving the company, he received nearly 5,000 shares as part of his equity compensation. During his tenure, the stock appreciated by over 500%, and today trades near its historical high of around $750 per share.

He was unwilling to realize the position immediately due to the significant capital gains tax burden. At the same time, approaching 80 years old, he was increasingly concerned that pharmaceutical stock volatility could erode the wealth he had spent decades building.

In June 2024, I designed a custom covered call strategy for him.

The structure was simple:

Gradual stock liquidation at elevated price levels

Monthly sale of call options to market counterparties

Ongoing collection of option premiums

This allowed him to:

Maintain equity exposure

Continue receiving dividends

Generate approximately $2,000 per month in stable income

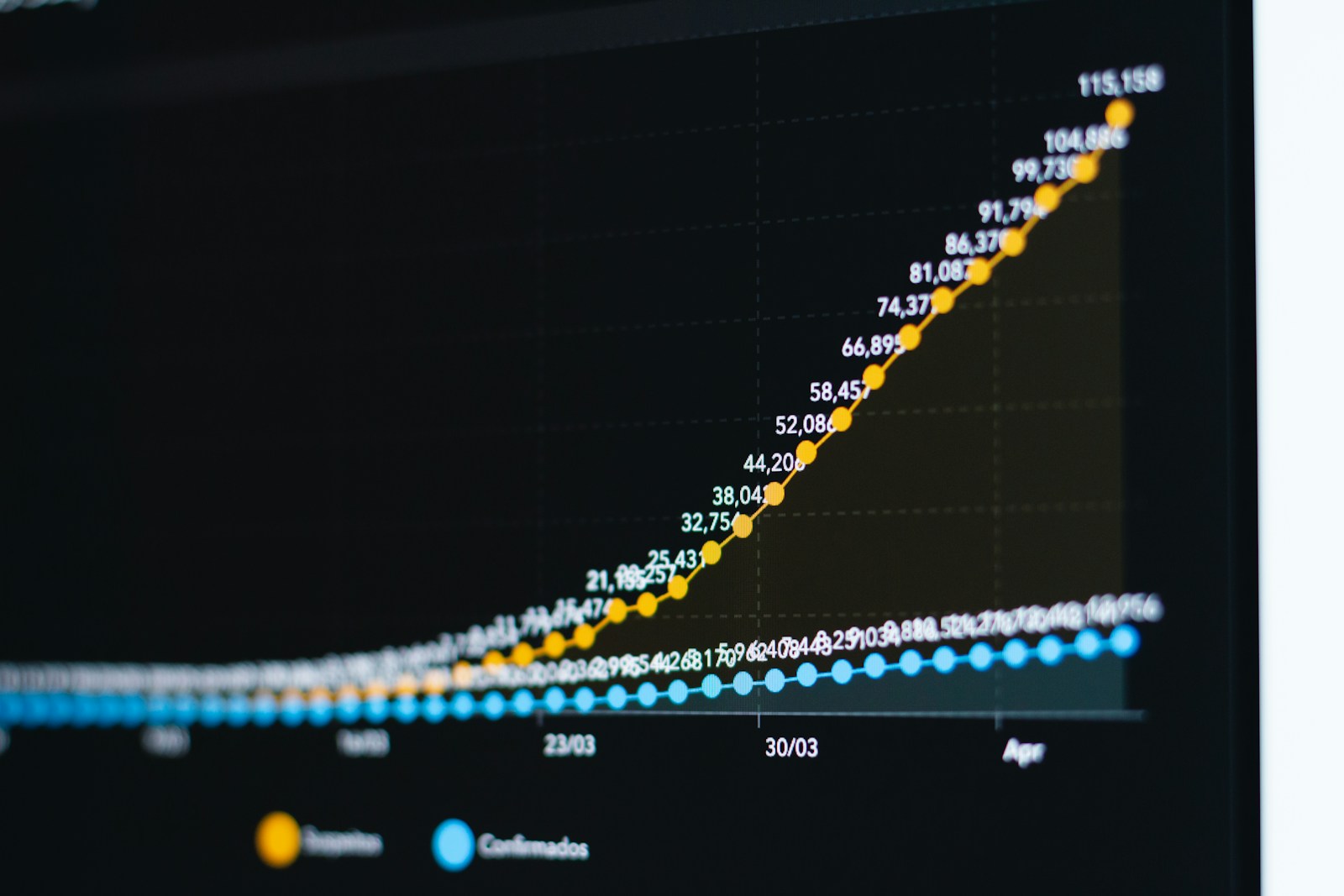

Over the following 15 months, Eli Lilly experienced a maximum drawdown exceeding 17%.

Because of the option premium income and partial liquidation structure, his portfolio’s maximum drawdown was limited to approximately 12%.

The sustained price weakness also created opportunities to continue selling shares at lower tax cost, further improving the after-tax outcome.

The covered call strategy is not suitable for all investors. For many portfolios, it has little relevance.

However, it is highly effective for investors with specific structural characteristics:

Executives and professionals forced to hold large single-stock positions due to employment compensation

Investors constrained by significant capital gains tax exposure

Retirees who require stable cash flow to support lifestyle needs

By contrast, young growth-oriented investors seeking maximum capital appreciation are generally not ideal candidates.

Covered call strategies inherently trade upside potential for income stability.

If the stock rises sharply, the option buyer will exercise the contract, and the shares must be sold below market price.

As a portfolio manager, this requires a deliberate trade-off between:

certainty of income

and

unlimited upside potential

There is no universal “right” answer — only suitability.

Accurate market regime assessment is critical.

Volatility analysis is equally essential.

This strategy represents only one of many efficient wealth management tools that I will continue to share — each designed for different capital structures, life stages, and objectives.