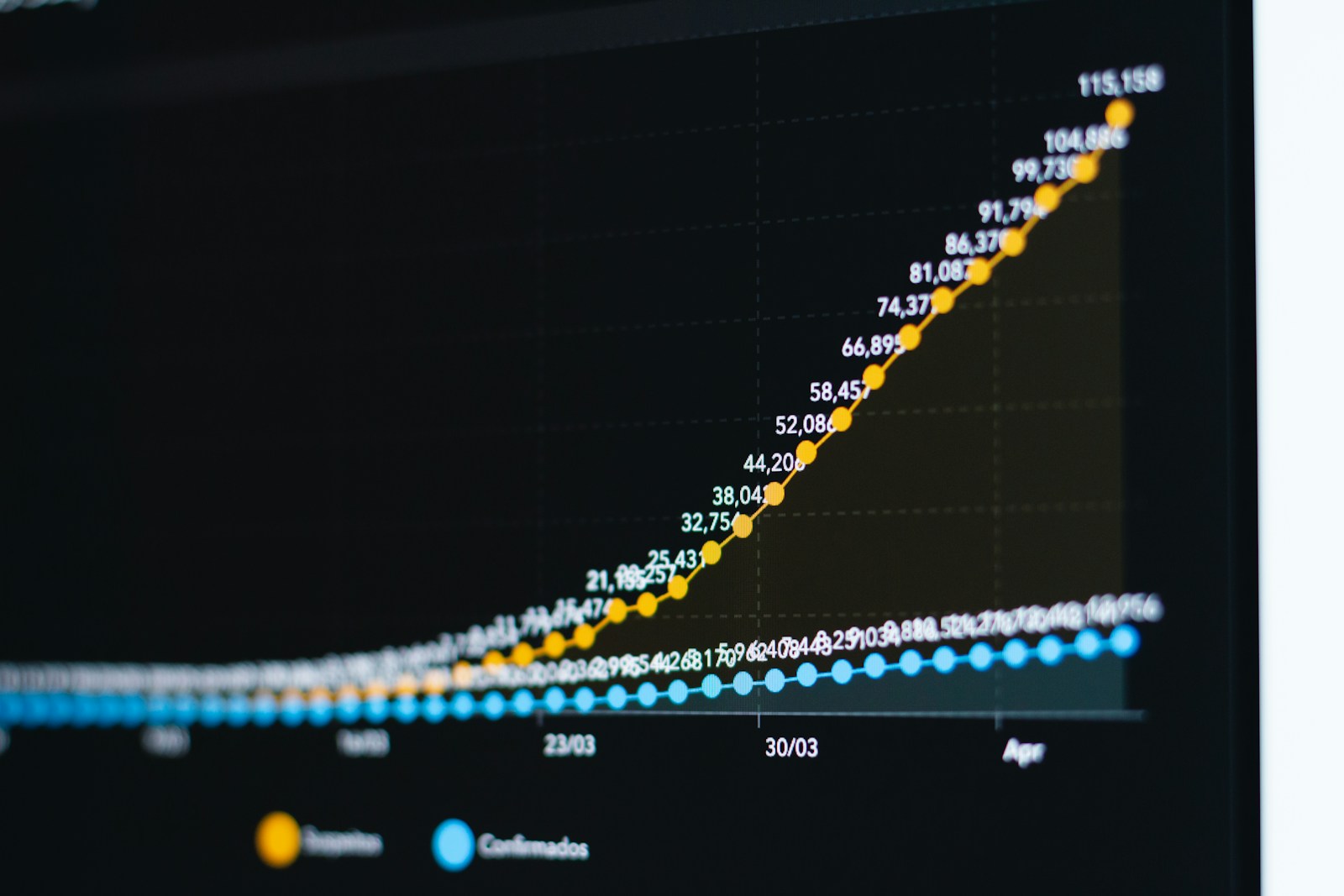

If you put one dollar into Berkshire Hathaway in 1976, it would have grown to over eight thousand dollars by 2025. During this time, its average annual excess return was 19.8%, which is much higher than the market’s 8.2% during the same time. But the most significant thing is that this return didn’t come from taking a lot of risks. Berkshire’s annualized volatility was 23%, which gave it a Sharpe ratio of 0.8, which is much greater than the market’s 0.5.

When you look at risk-adjusted return metrics like the Sharpe ratio and information ratio, Berkshire is at the top of practically all stocks and funds. It comes in first place, especially among stocks and funds that have been around for more than 50 years. If an asset portfolio could provide 72% of its weight to Berkshire, the Sharpe ratio for the whole portfolio might reach 0.81, which is the best possible ratio.

A lot of people think that Buffett doesn’t utilize leverage, but he has always employed “hidden leverage,” the most crucial of which is the insurance float that never runs out. The average degree of leverage for Berkshire is roughly 1.7 times, and the cost is very modest. The main sources of its leverage are:

1.Insurance float: Getting premiums up front and putting off claims, which is like low-cost or even negative-rate “financing.”

2.Issuing debt with a high credit rating: Long has AAA ratings and very low costs of borrowing money.

3.Tax benefits: Accelerated depreciation and deferred taxes are like “interest-free loans.”

With this leverage, Buffett can get high returns and high volatility while keeping his asset allocation fairly steady. Thishi also explains why his stocks fluctuate more than his portfolio of holdings.

Looking at Berkshire’s 13F filings and balance sheets and concluded that Buffett’s success derives mostly from the publicly traded firms he owns, not from the private companies he runs. This backs up the idea that Buffett is more of a good stock picker than a business owner. So what kinds of stocks does he buy? Buffett likes companies that have the following three main traits:

1.Low Beta (low risk): tends to pick companies that are “stable.”

2.High quality means that the company has stable profits, healthy growth, and a great asset-liability structure.

3.Low price: The usual way to think about value investment.

While you take these things into account while looking at earnings, Berkshire’s “excess return” (Alpha) is no longer statistically significant. This proves that Buffett isn’t doing “inexplicable” magic tricks; he’s getting returns through logical reasoning.

After you copy his risk-return parameters and change the leverage levels to match Berkshire’s volatility, this systematic portfolio’s performance is almost the same as Berkshire’s. The backtested portfolio is very similar to Berkshire’s actual performance, especially in the public holdings part (with a correlation coefficient of up to 73%).

Structured wealth management, trusts, and fixed-income products are things that Chinese investors are commonly familiar with. These products get their profits from the way financial institutions are set up. Berkshire is basically a diversified industrial holding company with a lot of high-quality U.S. stocks and businesses in railroads, utilities, manufacturing, insurance, and more. Its essence is the ability to run capital operations based on internal profits.

Berkshire always puts “cash generation capability” and “margin of safety” at the top of its list of things to look for in an investment. For instance, after buying BNSF Railway in 2010, it now makes around $6 billion in reliable operational profits every year. GEICO insurance also gives Berkshire low-cost float, which it then reinvests in other high-quality assets, creating an internal circulation.

Structured wealth management, trusts, and fixed-income products are all things that Chinese investors usually know about. These products’ profits derive from the way financial institutions are set up. Berkshire is basically a diversified industrial holding company that owns railroads, utilities, manufacturing, insurance, and a lot of high-quality U.S. stocks. Its main function is to manage capital based on earnings from within.

In his 1994 annual report, Buffett said, “Ben Graham taught me 45 years ago that you don’t have to do anything special to get great results when you invest.” We finally have real-world evidence today to back up this claim.