Every May, Berkshire Hathaway, which is owned by Warren Buffett, conducts its annual meeting for shareholders in Omaha. This year was no different. But this year’s gathering was not only the last one with Warren Buffett as CEO; it was also a major turning point in his 60-year legendary investment career. As usual, the almost seven-hour meeting was full of highlights. They talked about changes to the company’s strategy, record cash reserves, deep thoughts on AI and global trade, long-term holding logic for Japan and Apple, worries about budget deficits and tariff wars, and Buffett’s strong beliefs in emotional management and free markets. This showed his consistent investment wisdom and long-term view.

Families in North America with a lot of money and a lengthy history of compounding don’t trade very often. They decide to put their primary assets into a small number of business-type assets that can handle market ups and downs. Berkshire is a famous example of this. For investors, getting to know Berkshire and taking part in its profit sharing is less about learning about a company and more about changing how they think about investing and making money for the rest of their lives.

Structured wealth management products, bank-distributed trusts, and fixed-income products are all common types of investments for Newcomer people. These products are designed by institutions to provide returns. Berkshire is basically a holding company for a wide range of industries, including railroads, utilities, manufacturing, insurance, and a lot of high-quality U.S. stocks. Instead of being a standard investment tool, it works more like a platform for operational asset portfolios.

Buffett and his staff have been in charge of Berkshire’s capital allocation for a long time, focusing on stability, conservatism, “margin of safety,” and “cash generation capability.” This is different from standard mutual funds or ETFs that have delegated management. This means that you’re not investing in what the market thinks; instead, you’re following a disciplined, profit-focused asset portfolio management methodology. Think of it this way: instead of buying and selling stocks, you’re buying a piece of a corporate empire run by the best investor in the world.

For instance, in 2010, Berkshire bought BNSF Railway, one of North America’s largest freight railroads, and since then it has steadily made about $6 billion a year in operating profits for investors and the company. These profits have been stable not because of market volatility but because of the transportation services themselves. It’s like having a stake in a toll road that trucks and trains use every day, with each trip instantly turning into money for your investment.

Berkshire also gets long-term, low-cost “float” from GEICO, one of the top five vehicle insurers in the U.S., for future investment opportunities. The float mechanism is really smart: clients pay their premiums up front, but claims usually don’t happen for months or even years. Buffett can use this money to make investments without paying any fees during this time. This float is now worth more than $160 billion, which is like getting a jumbo loan with no interest or even negative interest.

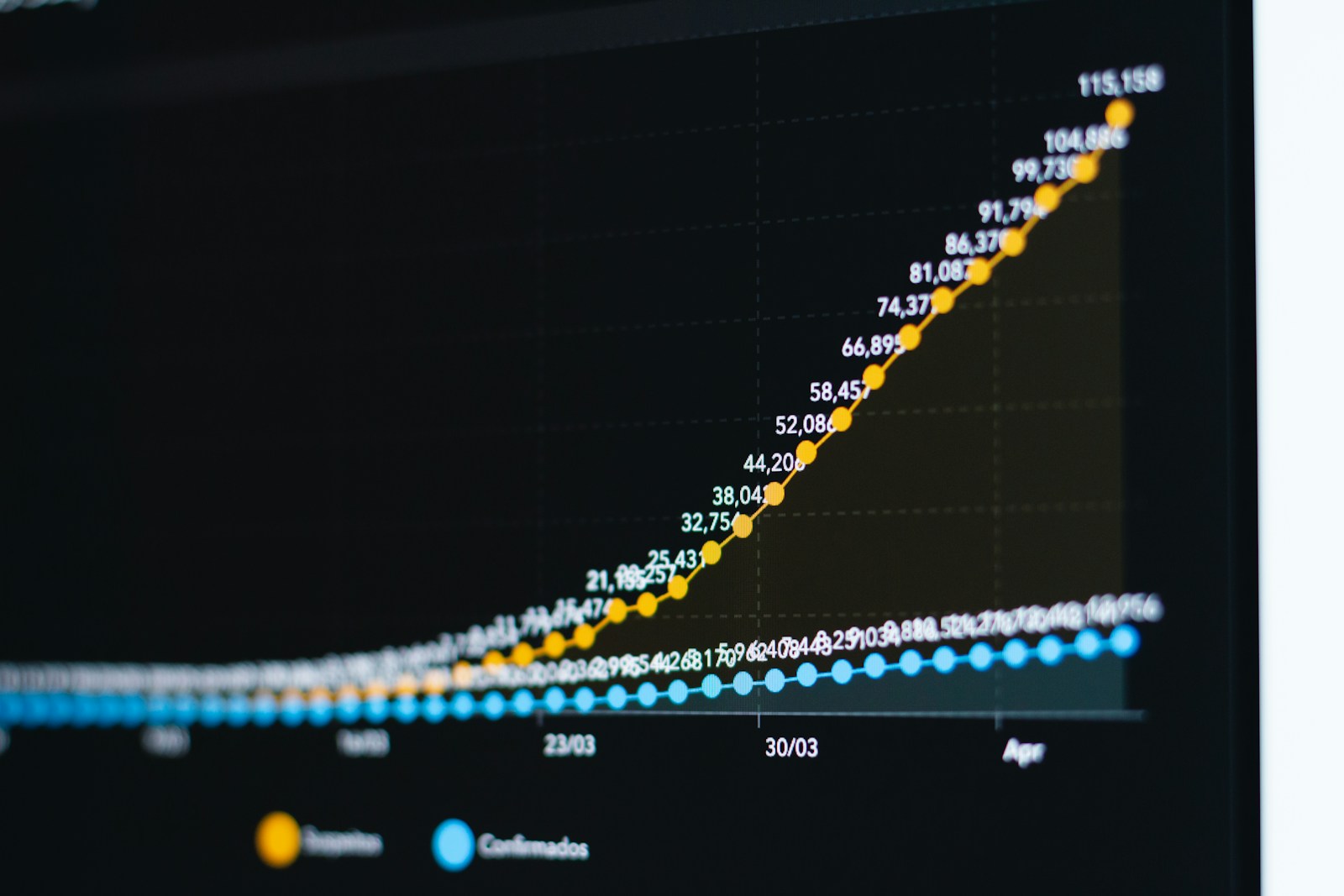

Berkshire’s growth doesn’t depend on high valuations or stories about “future earnings potential.” Over 90% of its net assets derive from steady operating income and cash flows from high-quality enterprises instead. This basic difference in logic makes it a defensive asset during times of economic stagnation.

until instance, look at Trump’s tariff policies until 2025. Berkshire not only kept its net asset value consistent throughout times of high volatility in the U.S. stock market, but it also boosted its long-term holdings in the energy, consumer goods, and banking sectors. Why? Because these are basic commodities and services that people need no matter what the economy is like. Buffett was seeking for chances to buy additional quality assets while other investors were worried about how volatile the market was.

What makes it appealing is that it doesn’t depend on high volatility or short-term thematic investing; instead, it relies on underlying asset structures that are naturally strong and can grow over time. It’s like putting money into a family business that never stops running instead of playing a game of chance.

More crucially, Berkshire’s annual volatility is much lower than the market average, and its maximum drawdowns are much lower than those of technology growth assets. Berkshire is one of the few single assets that has both “excess returns” and “risk mitigation capabilities.” This makes it a good core investment for high-net-worth portfolios. Think about getting returns that beat the market while avoiding the sleepless nights that come with big changes.

Berkshire offers three times the value of a traditional financial product. The first is its ability to build on itself. Its own operations bring in a lot of free cash flow each year, which helps keep long-term net value growth stable. Free cash flow this year hit a record $367.7 billion, which is available to be used quickly when market opportunities come up. It’s like having a money-making machine that keeps your investment portfolio full.

Its second function is to act as a liquidity bridge. Berkshire Class B shares trade every day on U.S. markets, unlike structured products or PE/VC lock-up periods. This makes them a good choice for high-net-worth clients who manage assets in more than one currency and account. You can sell your assets anytime in the market if you need money. You don’t have to wait for the product to mature or find purchasers.

Third, it protects against inflation. A lot of its business has to do with real assets and consumer endpoints, which naturally protects it from currency depreciation. When inflation happens, railroads can boost freight rates, insurance companies can change premiums, and utilities can ask for rate hikes. All of these things directly protect investors’ real buying power.

Also, since the company never pays dividends and expands by reinvesting its profits, it’s especially good for investors in high-tax areas (like Canada) who hold their shares in non-registered or corporate accounts because it is more tax-efficient. You don’t have to pay taxes on dividends every year, but you can choose to realize gains at the best time to make the most of tax planning opportunities.

It’s very important to have a good understanding of how the insurance company works. Berkshire’s insurance operations are not just regular insurance companies; they are also platforms for allocating money. Customers pay premiums, and the corporation takes on risks. However, these funds might be invested before claims are made. This strategy is so smart that if the insurance company does its job right, the cost of float can even be negative. This means that other people not only lend you money for free, but they also pay you interest.

Buffett has made this model work perfectly by carefully pricing risk and following stringent underwriting rules. This makes sure that insurance companies make money in the long run. In the meantime, the huge float gives him the tools he needs to buy high-quality assets quickly when the market is in a panic. This is why Buffett was able to buy shares in Goldman Sachs, General Electric, and other good companies during the 2008 financial crisis, while other investors were selling. He made a lot of money.

Berkshire’s investment philosophy also shows how hard it works to find good businesses. Buffett says a lot that he’d prefer purchase good firms at fair prices than bad enterprises at low prices. Berkshire’s investments in Apple, Coca-Cola, Bank of America, and American Express are ideal examples of this investment reasoning. All of these companies are industry leaders with strong moats and steady profits.

Berkshire can be one of the main holdings in a “core-satellite strategy” for families who want to establish strong wealth structures. It can work with ETFs, defensive cash, and overseas real estate to provide active capital growth reasoning that these other assets can’t. It is not a standard growth company in the tech sector or a pure value defensive stock; it is a whole asset platform that works through all economic cycles.

A lot of investors still think in terms of “products,” always looking at yields, duration, and payout mechanisms. But in mature markets, asset allocation really is about managing the quality, predictability, commitment to compounding, and “risk stickiness” of all the family’s assets. This is what makes Berkshire so special: it changes you from a buyer of products to a business owner and from someone who wants short-term returns to someone who wants to develop wealth over the long term.

When you put money into Berkshire, you’re really putting money into a business model and investment philosophy that has worked for more than 60 years. This technique doesn’t depend on timing the market or complicated financial engineering. Instead, it depends on knowing a lot about good businesses and keeping them for a long time. In a world where nothing is guaranteed, this assurance is the most valuable thing.